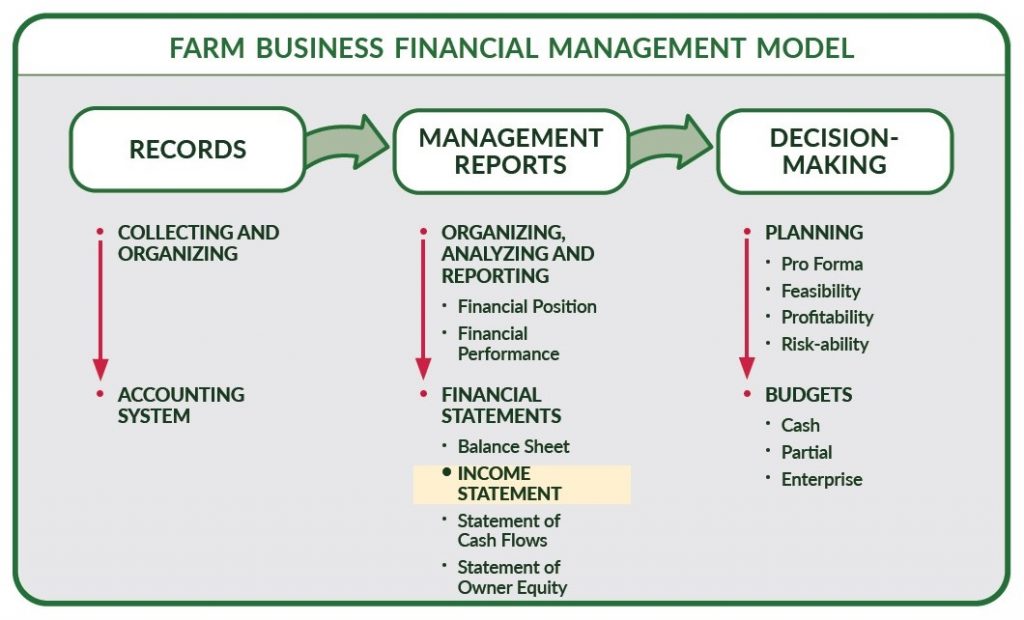

The Income Statement is one of the four primary farm business financial statements that are recommended by the Farm Financial Standards Council (FFSC). Its purpose is to measure profits and financial performance of the farm business. While there are many financial metrics to track in a farm business – owner equity, debt structure, leverage, etc. – all can improve if there is greater profitability.

There are two Income Statements – Cash and Accrual. With some exceptions, the Cash Income Statement tracks incoming cash revenues and outgoing cash expenses. Exceptions are that the non-cash expense of depreciation is included on the cash income statement and cash payments of principal are not included. The Cash Income Statement is a close cousin to the Internal Revenue Service (IRS) form 1040F (Profit or Loss from Farming), also known as Schedule F. While the Cash Income Statement is a useful tool for taxes, it does not necessarily reflect true performance in a farm business or provide information for good decision-making. Measuring true performance and accurate information for decision-making requires the Accrual Income Statement.

The Accrual Income Statement tracks revenues when they are realized, that is, when the product is available and ready for sale, even if that is not when it is sold. For example, corn that is planted, grown, harvested, and available and ready for sale in 2021 is considered revenue in 2021 even if it is not sold until 2022. Similarly, expenses for the 2021 crop are recognized in an Accrual Income Statement in 2021 even if they were pre-purchased in 2020.

John had total cash revenues of $1,500,000 and cash operating expenses of $1,525,000. Thus, net cash income is negative $25,000. It does not appear that John had a good year. However, the tracking of just cash does not tell the whole story. John has $140,000 of grain in storage from this year’s crop that he has not sold yet and thus it does not show up on the Cash Income Statement. John also prepaid $30,000 of next years input expenses this year, which does shows up as a cash expense this year even though it is for inputs that will be used next year. Adding the revenue that truly occurred this year and subtracting the expenses that truly belong to next year, John’s true performance is a positive $145,000 (-25,000+140,000+30,000).

Creating an Accrual Adjusted Income Statement is a challenge of adjustments. One starts with the Cash Income Statement and uses the beginning and end of year Balance Sheet to adjust the Cash Income Statement to appropriately realize income and expenses when they operationally occur.

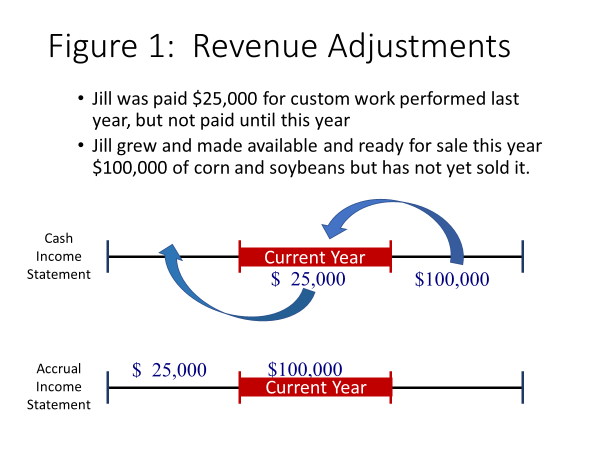

Figures 1 and 2 illustrate adjustments for farmer Jill.

Figure 1 shows Jill’s revenue adjustments. Jill performed custom work last year but did not collect on her work until this year. Operationally, that was income earned last year, not this year and thus an adjustment must be made to move that $25,000 of revenue on this year’s Cash Income Statement to last year. Similarly, Jill did the work of planting, caring for, and harvesting $100,000 of corn and soybeans this year, but she has not sold it yet. The income was truly earned this year and thus an adjustment must be made to add it to this year’s revenues.

Figure 2 shows similar adjustments, except in this case it is for expenses. At the end of last year, Jill prepaid $20,000 worth of inputs (seed, fertilizer, etc.) that she will use on this year’s crop. While the cash was paid last year, operationally, the inputs were not used until this year’s crop. Likewise, she prepaid $40,000 of inputs this year (paid the cash this year), but it was for inputs that won’t be used until next year’s crop. Thus, they “belong” as an expense on next year’s crop.

Which income statement should one use? The answer is both. Farm managers can make wise use of Cash Income Statements for the purpose of managing taxes. But the same Cash Income Statement may lead to erroneous information for decision-making. The Accrual Income Statement measures “true” profitability performance each year and provides the management information needed to make optimal decisions for the future.

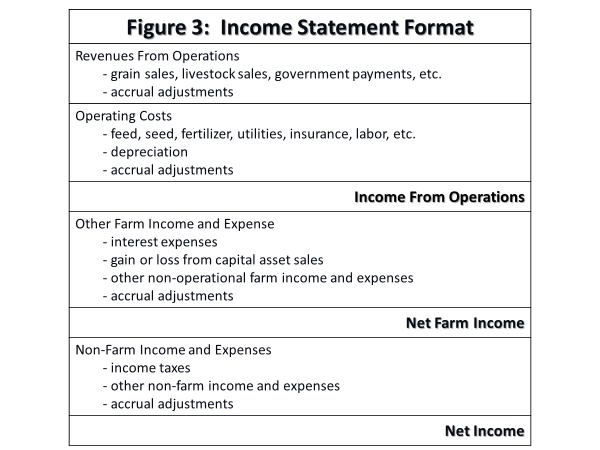

The Farm Financial Standards Council (FFSC) recommends an income statement format as shown in Figure 3. This format segregates operational income (Income From Operations) from income and expenses accruing from non-operational and/or non-farm activities.

If any cash exchanged hands as a revenue or expense it goes on the Cash Income Statement. If no cash exchanged hands then it does not go on the Cash Income Statement.

Answer: FALSE. Generally, this statement is true, but there are some important exceptions. The non-cash expense, depreciation, is included on the Cash Income Statement. Also, the cash outlay for principal payments and for capital asset purchases does not go on the Cash Income Statement. Note, depreciation accounts for the expense of capital assets.

Answer: Accrual Income Statement. The Cash Income Statement accounts for the flow of cash, but does not account for the production and operational activities in a given accounting period. True realization of revenues and expenses is accounted for on the Accrual Income Statement.

Answer: The Beginning Balance Sheet and the Ending Balance Sheet enable managers to adjust the cash income statement for changes in inventory items. Adjustments are made for revenues, unused assets, unpaid items, accrued interest and taxes.

Answer: FALSE. The Internal Revenue Service (IRS) allows farm businesses to use cash accounting for income tax purposes. This is a useful management tool as farm managers can make decisions to either defer revenues or pre-pay expenses, all of which can lower tax liability. Therefore, the Cash Income Statement is the best for tax management.

References: Farm Financial Standards Council. (2021, January). Financial guidelines for agriculture.

The University of Wisconsin-Madison Division of Extension Financial Management & Strategic Planning programs, information and resources intend to improve the farm financial and decision-making skills of Wisconsin agribusiness, farmers and farm managers, agricultural lenders and educators.

To stay up to date on the latest information and upcoming programs from Farm Management, sign up for our newsletter.